KEY LEGAL COMPLIANCES – CHECKLIST FOR NEWLY-ESTABLISHED COMPANIES (P1)

Ensuring legal compliances right from the beginning of your business makes all the business activities of your company can be operated effectively as well as to avoid legal risks. Therefore, for Clients provided with our retainer legal services will always be advised fully, comprehensively on legal issues right from its get-go. This article is aimed to provide you with a background understanding of legal aspects that new businesses should consider:

- Compliance with laws on investment and laws on enterprises (Link: Part 1)

- Compliance with laws on finance, tax, and accounting regime (Link: Part 2)

- Compliance with laws on employment and protection of employee’s rights and interests (Link: Part 3)

Cre: vivabcs.com.vn

Part 1: Compliance with laws on investment and laws on enterprises

1. Ensuring the schedule of capital injection and issuing Membership/Shareholders Register Book (For multi-member limited liability companies and joint-stock companies)

After establishment of an enterprise, the company’s owner/ member of the company/ shareholder must contribute or inject the charter capital as their commitments under the Company’s registration application. The capital injection must be completed under the provisions of law as follows:

Besides the Member’s obligation of capital injection, the enterprise shall issue a Membership/ Shareholders Register Book right after the Enterprise registration certificate is granted and the Membership/ Shareholders Register Book shall be kept at the headquarters of the Company or by the Securities Depository (for public companies).

In return for the capital injection from the Members or appropriate payment for subscribed shares by the Shareholders, the company shall issue for each Member/ Shareholder a Certificate of capital contribution. This is deemed to be a piece of important evidence for the ownership of Members/ Shareholders to their membership interest or shares.

2. To ensure the fulfillment of business conditions/ requirements

Ensuring to follow certain requirements set forth in all Laws is a common matter that almost all companies are concerned at its beginning. According to the law of Vietnam, enterprises operating in specific industries and/ or performing special commercial activities fallen into the list of conditional business lines must, before and during its operation, meet and maintain conditions and requirements stipulated under the Laws. Those conditions and requirements are very diverse such as requirements of business premises (area, appropriately equipped with fire protection system, the minimum distance from the premises to school, noise pollution prevention and control…); human resources (qualified experts, licensed doctors…) and standard equipment. Besides, there are also some specific requirements prescribed by laws applied only for FDI companies.

It is important to note that the business lines that enterprises register at the Business Registration Office at the time of establishment are just a notice as ‘‘registered business lines’’ to state authorities to record business information into the national information system. This notification does not mean that the enterprises have been certified as eligible to operate in the field of conditional business investment.

The most common way that the Vietnam Government often uses to manage and supervise whether companies have complied with rules as regulated under the laws is granting licenses/ certificate for qualified and eligible companies. In other words, unless fulfillment of specific requirements in some fields as set forth under the laws, that company is not allowed to operate such kind of business. In case of detection of unlicensed business, the authority will impose penalties or sanctions.

To ensure the fulfillment of the business and investment conditions is important for all enterprises. It demonstrates the enterprise’s spirit of compliance with the laws as well as creates trust for the Company’s customers and partners. Besides, meeting and maintaining all aforementioned business and investment conditions will help enterprises avoid legal risks (such as being sanctioned for administrative violations, required to suspend business activities) or ensure the legal rights and interests of your Company in case of disputes.

Regarding the above-mentioned risks when a business – commercial dispute occurs, Le & Associates suggested that ‘‘conducting business in conditional business and investment fields without having fully met the requirements or holding licenses prescribed in the Laws or failing to ensure the maintenance of such requirements in the course of operation” is considered as one of the ‘‘prohibited practices” under Article 17.6 of the Law on Enterprises 2014. Therefore, if the enterprise intentionally conducts business investment activities without checking legal requirements or failing to ensure the maintenance of the legal conditions, it will lead to the legal risk that all contracts and transactions with partners/customers within the scope of business investment activities are at risk of being declared as invalid contracts due to it ‘‘violates the prohibition’’ (Article 123 of the Civil Code 2015).

3. Filling reports (applicable to foreign-invested enterprises)

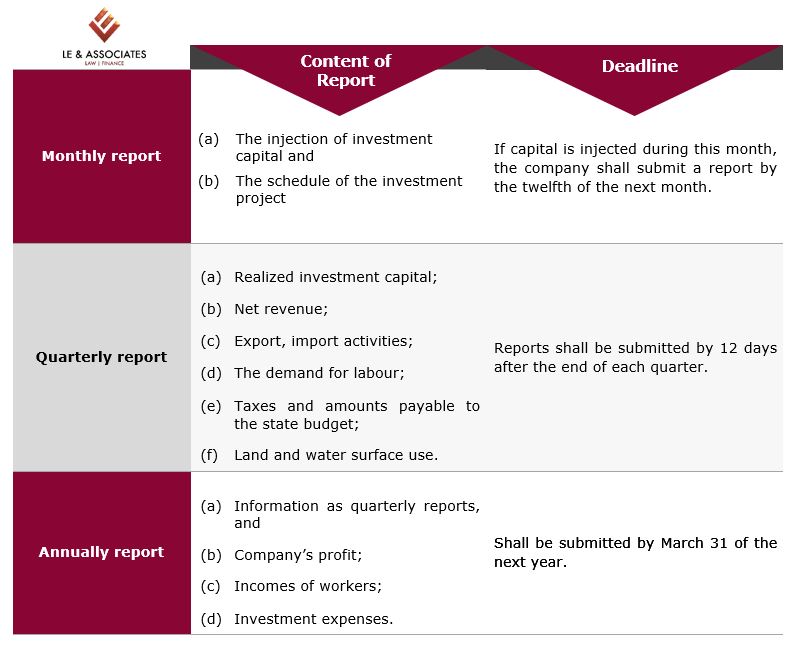

The investors and FDI companies implementing investment projects are obliged to report the local investment registration authority and statistic authority on their Investment activities monthly, quarterly, and annually. This obligation always mentioned in the Investment Registration Certificate as below:

Reports performed by our Client

(Dịch bổ sung)

So you may have self- questioning that which information must be reported? Kindly see our brief below:

4. Company’s seal

The seal/ stamp is considered as a sign representing the legal validity of each document issued and sealed by the company. The seal is often used in documents and reports to affirm and ensure the reliability and accuracy with respect to the competence in issuing such documents. Therefore, before operating, each enterprise needs to design its own seal. Enterprises can contact the company allowed to engrave seals to order the seal.

4.1 Recognising the validity of the Company’s seal

In Vietnam, the official usage of a seal will recognise the validity of the Company’s seal as being representative of the company and not the individual signing a document. In many court cases, documents of a company contain only a signature of its general director is still considered insufficient. According to Article 44.4 – the Law on Enterprises 2014, the Seal shall be used in the cases stipulated by laws or in the transaction that parties have agreed on the use of the seal. Thus, when there is a regulation clearly stipulates that the use of the seal is required or where the transactions contain the terms that using the Company’s seal is mandatory, then the expression of the Company’s seal shall be required to ensure legal validity for these documents.

Besides, in case that a document consists of more than one page, it is also common in Vietnam to seal on adjoining edges of pages. By this way, the seal bearing as a bridge or integrity seal among those pages and no one can replace any original page.

4.2 The number of seals and how to manage the usage of the seals:

In Vietnam, it is under the discretion of each company to decide the number of seals it wants as stipulated in Article 44 of the Law on Enterprises 2014, the enterprise has the right to decide on the number, form, and contents of its seal. The contents of a seal must contain information about the enterprise’s name and the enterprise registration number. The seal shall be managed, used, and retained under the Articles of Association.

When supporting our Clients to establish their companies, Le & Associates always thoroughly research the Clients’ needs and advise them the number of seals they should have as well as the method of managing the seal. For example, most FDI enterprises (100% foreign-invested capital companies) often desire to have at least two seals to ensure the convenience of the parent company’s decision-making process from abroad. Accordingly, one seal shall be kept at the Company’s head office and the other seal shall be managed and kept by the parent company abroad.

4.3 Required procedures – Notice of seals

Before using the seal, the enterprise is obliged to notify the seal to the business registration office/ business registrar where it is headquartered. The business registrar then will publish the company’s seal on the National Business Registration Portal.

5. Hanging billboard/office signs at the Headquarters

5.1 What must be shown in the billboards/ office signs

The enterprises must have their billboard/ office signs which consist of the following information:

- The name of the supervisory authority (if any);

- Full name in Vietnamese as stated in the enterprise registration certificate granted by the competent authorities;

- Type of the enterprise;

- Main business lines (for manufacturing, trading in goods and services premises);

- Trading location, phone number (if any);

- The billboard/ office signs might include the logo as registered to the competent authorities; the area of the logo must not exceed 20%; the content of the signboard must not contain any information advertising for any goods, services.

5.2 The expression of billboards/ office signs

The billboards/ office signs must be aesthetically pleasing and the text on the boards must be written in Vietnamese; in case you want to show the abbreviated name, international trading name, foreign name, or text, those must be placed bellow and smaller than the Vietnamese text.

5.3 Position, size of signboards

Signboards shall only be written, placed close to the gate, or in the front of the head office or at your business premises; each enterprise shall only have only one signboard at the gate; at the office or business location independent from other organizations or individuals, only one horizontal signboard shall be placed and no more than two vertical signs.

The signboards must not overshadow the emergency exits and fire fighting equipment; they also must not encroach on the pavement, the road, or affect the public traffic.

The signboard shall be hung at the head office of the enterprise and may be made in the horizontal or vertical form with limited size as follows:

- For horizontal signs, the maximum height is 02 meters (m), the length must not exceed the width of the front of the house;

- For vertical signs, the maximum width is 01 meters (m), the maximum height is 04 meters (m) but must not exceed the height of the floor where the signboard is located.